santa clara county property tax collector

The Controller-Treasurers Property Tax Division allocates and distributes the taxes to the appropriate jurisdictions. Property assessments performed by the Assessor are.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

. 1 2022 - May 9 2022. Home - Department of Tax and Collections - County of Santa Clara. View and pay for your property tax billsstatements in Santa Clara County online using this service.

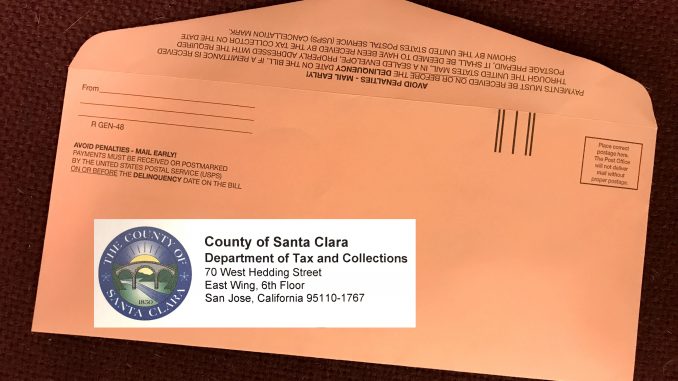

Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022. The Property Tax online viewpay system will be unavailable from 1200AM - 500PM on July 1 2022 due to fiscal year end maintenance. 12345678 123-45-678 123-45-678-00 Department of Tax and Collections.

Santa Clara County California. The homeowners property tax exemption provides for a reduction of 7000 off the assessed value of an owner-occupied residence. Closed on County Holidays.

Last Payment accepted at 445 pm Phone Hours. You can get the information from the Assessors Office located at 70 West Hedding Street San Jose East Wing 5th Floor Monday through Friday between the hours of 800 am. Masks are optional for visitors of County facilities but are strongly encouraged.

Business Property Statement Filing Period. Enter Property Parcel Number APN. Do not send cash.

What information do I have to give to you before I can access the data. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. 2022 County of Santa Clara.

The Santa Clara County Assessors Office located in San Jose California determines the value of all taxable property in Santa Clara County CA. To pay Property taxes for Secured property you will need your Assessors Parcel Number APN or property address. They are maintained by various government offices in Santa Clara County California State and at the Federal level.

Currently you may research and print assessment information for individual parcels free of charge. Ad Need Property Records For Properties In Santa Clara County. Property owners who occupy their homes as their principal place of residence on the lien date January 1st and each year thereafter are eligible.

Uncover Available Property Tax Data By Searching Any Address. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes. The Department allocates and distributes property taxes accurately and timely to taxing entities including the County school districts cities and special districts.

They are a valuable tool for the real estate industry offering. Office of the Treasurer Tax Collector. Include Block and Lot number on memo line.

The inclusion of a link to. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Click here to register it now.

You can pay tax bills for your secured property homes buildings lands as well as unsecured property businesses boats airplanes. Send us a question or make a comment. For information on the States Homeowner or Renter Assistance Program call the Franchise Tax Board at 800 852-5711.

Due Date for filing Business Property Statement. Send us an Email. Find Information On Any Santa Clara County Property.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 or older blind or disabled. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County. And reconciliation of the extended tax roll prior to certifying to the tax collector for tax bill printing mailing and collecting.

Last Day to file Business Property Statement without 10 Penalty. Make checkmoney order payable to SF Tax Collector. Enter Property Address this is not your billing address.

County of Santa Clara cannot attest to the accuracy of the information provided by the linked sites. The canceled checkmoney order stub serves as your receipt. This translates to annual property tax savings of approximately 70.

Click here to contact us. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. MondayFriday 800 am 500 pm.

Ad Pay Your Taxes Bill Online with doxo. The Tax Collectors Office is open to the public from 900 AM - 500 PM Monday through Friday. MondayFriday 900 am400 pm.

Save time - e-File your Business Property Statement. Assessors Account Number Business Name or Business Address.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Warning About Deceptive Tax Lien Mailer Santa Clara County Sheriff Mdash Nextdoor Nextdoor

Info Santa Clara County Secured Property Tax Search

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Longtime Santa Clara County Assessor Looks To Be The Winner Again San Jose Spotlight

Santa Clara County Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Santa Clara County Property Tax Tax Assessor And Collector

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Info Santa Clara County Secured Property Tax Search

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara